DoorDash, the local commerce platform with over 32 million active monthly users, today released a new report based on a survey of 1,200+ DoorDash customers that reveals a change in how consumers are purchasing grocery, household, personal care, pet care, and alcohol products or consumables. With this, brands have the opportunity to capitalize on increased consumer demand and new purchase occasions. DoorDash also announced today new ad and promotions capabilities to keep brands at the forefront of shifting trends and preferences, capitalizing on the move toward convenience and the incremental purchases this unlocks.

“On-demand digital commerce is growing exponentially, and consumer shopping habits and expectations have shifted as a result of having nearly any product available for delivery within minutes,” said Toby Espinosa, VP of Ads at DoorDash. “But it’s not just how consumers shop that’s evolving. How they discover, interact and engage with brands has changed dramatically over the last few years, so brands and advertisers need to shift their approach, too.”

To collect the data for the report, Uncovering Consumer Trends in Retail Media, DoorDash surveyed 1,200+ US customers in August 2023 who made at least one consumable purchase in the last 30 days on DoorDash along with those who purchased a consumable item through a DoorDash ad in the last 30 days. The report found that the introduction of quick commerce — an emerging channel within digital commerce where shoppers can purchase consumable items for on-demand delivery — has led to a change in last-minute household needs, a consumer desire for faster delivery of consumables and a different path-to-purchase. Additional key findings include:

The way people purchase consumables is rapidly changing. The survey revealed that 62% of respondents are ordering consumables online more than they did last year. Even further, 81% of respondents reported purchasing consumables via a third-party app/website like DoorDash, search engines, or review sites in the past month. With more than 100,000 non-restaurant stores across our Marketplace and Drive platform, 99% of U.S. DoorDash consumers now have access to grocery, convenience, pet, flower or alcohol retailers.

The need for speed and convenience continues to be important. When shopping online for consumables, the top priorities for respondents are convenience (74%), ease of use (48%), and speed (46%). The average delivery time for grocery and convenience on DoorDash is around 33 minutes, making it easier than ever for consumers to get whatever they need, exactly when they need it.

Consumers are frequently adding impulse buys to their online orders. 60% of consumers surveyed are “somewhat or very likely” to buy new products while browsing online last minute, driven by last minute needs (55%) and the desire to “treat themselves” (45%).

Third-party app use has evolved — so advertising is changing, too. Consumers surveyed are open to finding new brands through advertisements and promotions, and the expectation is that marketing does not feel intrusive. The report showed that 73% of DoorDash consumers surveyed who had purchased an ad or promotion in the past 30 days did not think a promoted item in DoorDash felt like an advertisement.

GroupM, the world’s leading media investment company, provided the foreword to the report with North America CEO Kirk McDonald noting “these insights make retail media network advertising fertile ground for reaching your target audience with relevant, engaging, non-interruptive advertising to build your brand and drive tangible sales.”

Consumers shopping online aren’t just channel-shifting from brick and mortar to digital, giving brands an opportunity to reach incremental customers they wouldn’t have otherwise captured. Studies conducted across a number of grocery and convenience enterprise partners indicate that DoorDash is 70-90% incremental to their existing customer base, creating new consumer occasions.* In Q2 2023, DoorDash had the highest growth of customers in the industry new to placing convenience, grocery and alcohol orders, based third-party data.

To enable CPG brands to better connect with customers adopting digital commerce directly at the path of purchase, DoorDash continues to invest in growing capabilities, including new ad formats, deeper campaign insights, targeting, and consumer-driven deal constructs:

Sponsored Brands – Piloting New Ad Format: Brands can drive awareness and consideration via new high-impact carousels that combine brand assets with a shoppable selection of products, similar to an in-store end cap.

Sponsored Products – New Reporting Types: To better understand campaign performance, DoorDash has released new-to-brand reporting for campaign, product, and keyword-level. According to DoorDash data, Sponsored Product campaigns drive approximately 70% new-to-brand customers**.

Sponsored Products – Keyword Targeting: To enable deeper control and optimize ad campaigns towards highest-performant terms, DoorDash recently unveiled keyword-level targeting and reporting.

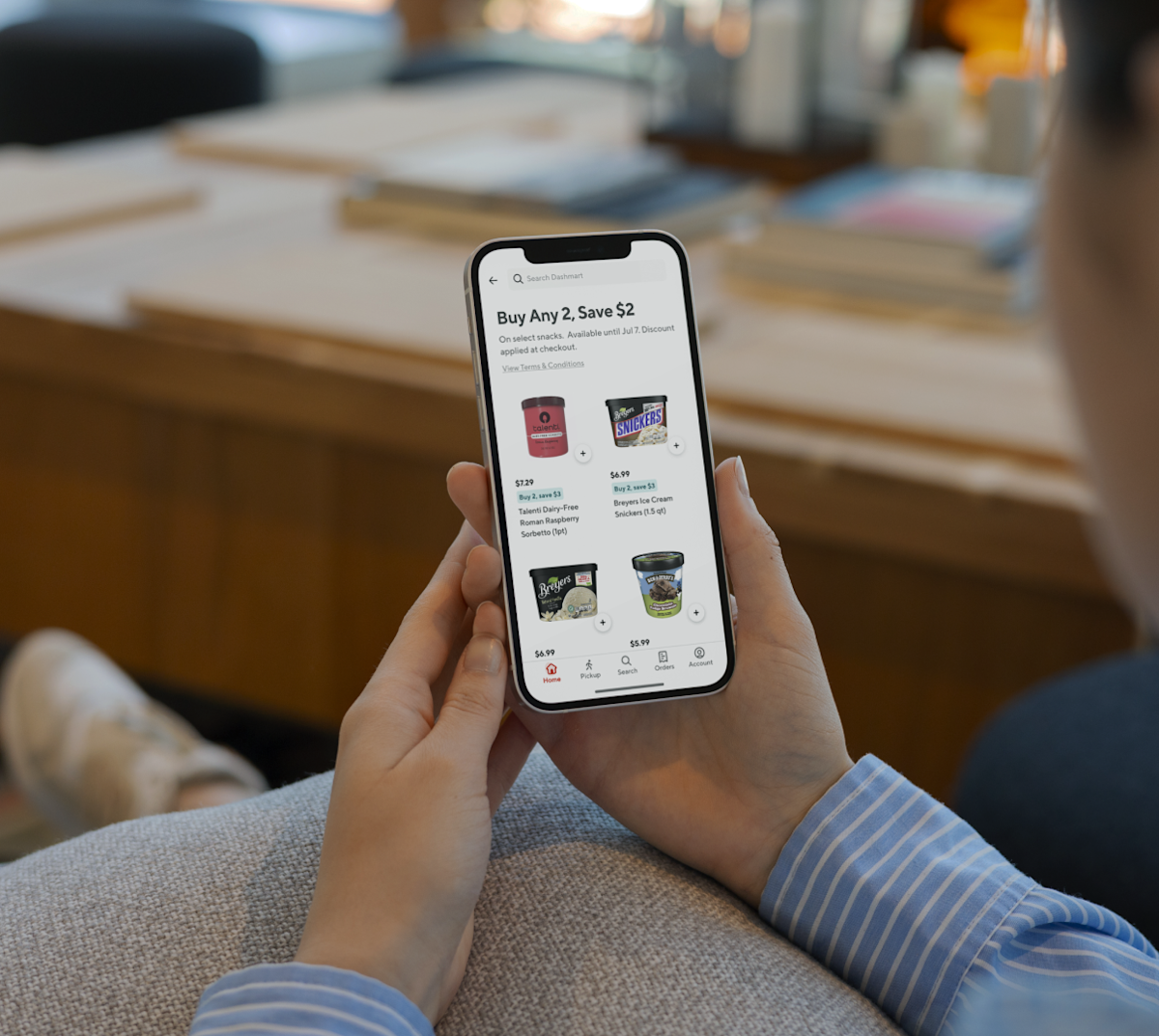

Item-Level Promotions – To drive trial and increase average basket size, brands can now run item level promotions featuring “Buy 2 items from a brand, save $2”. Promotions help reward consumers by savings, and brands can connect with new and recurring customers with an affinity to trial or stock up.

These solutions, alongside DoorDash’s existing offerings, give brands multiple tools to get in front of their customers throughout their purchasing journey, building on DoorDash’s promise to connect brands and merchants to our local consumers.

“At DoorDash, ads are a trusted way for consumers to discover brands that are relevant and convenient to them for every occasion,” said Espinosa. “Our multi-category momentum and scale gives advertisers a unique way to capture a high-intent audience and acquire new customers, driving efficiency to help grow their business.”

About Group M

GroupM is WPP’s media investment group and the world’s leading media investment company with a mission to shape the next era of media where advertising works better for people. The company is responsible for more than $60 billion in annual media investment, as measured by the independent research bureau COMvergence. Through its global agencies Mindshare, Wavemaker, EssenceMediacom, and mSix&Partners, and cross-channel performance (GroupM Nexus), data (Choreograph), entertainment (GroupM Motion Entertainment) and investment solutions, GroupM leverages a unique combination of global scale, expertise, and innovation to generate sustained value for clients wherever they do business. Discover more at www.groupm.com.

* DoorDash Grocery Trends Report

**4/1/23-6/30/23